About Prime Short Term Credit

We are a premiere collateralized lending platform designed to provide short term credit for building asset-based investment strategies. We work with experts in real-estate development, business development and other lending opportunities to help these individuals (or businesses) grow their asset-based portfolios.

Frequently Asked Questions

Each individual business must provide assets for every short term credit opportunity that we provide. This translates into “collateralized lending”: Prime Short Term Credit offers the financial backing to help a business grow, provided that they have one or more types of collateral:

Each individual business must provide assets for every short term credit opportunity that we provide. This translates into “collateralized lending”: Prime Short Term Credit offers the financial backing to help a business grow, provided that they have one or more types of collateral:

- Real Estate

- Business Lending

- Commercial Development

- Other Collateral or Equipment

- Transaction Financing

Home ownership provides security for individuals to build an investment over a lifetime. However, the ways that new generations buy homes has evolved:

- Looking for walk-in-ready homes

- Convenient locations in a good neighborhood

- Modern amenities and up-to-date features/colors

These considerations make house-flipping attractive for experienced renovators offering:

- High returns

- Short term credit financing

Taking care of home maintenance and changes on your primary home may be worthwhile for small projects (painting, landscaping, etc). DIY projects can be risky:

| Concentration Risk | You will only be able to work on one property at a time, with all your own financing at risk. |

| Lack of Experience | You will need to rely on experts for more complicated tasks. Sourcing top-quality contractors can be tricky unless you already have a rolodex of contacts ready to go. |

| Time Consuming | When this is a secondary project, it will take far longer than anticipated, especially when you run into issues beyond your expertise. |

As an experienced company with a wealth of opportunities, we have minimized the challenges that individuals face with the prospect of house-flipping:

| Broad Risk | Taking on everything from business lending, commercial rental properties to individual homes, we are positioned to weather many changes in the real estate market with a broad portfolio. |

| Vast Experience | Drawing on multiple operators to renovate properties, we have a plethora of experience in various renovation opportunities. |

| Breadth of Assets | Using our large portfolio of assets allows us to leverage additional financing if needed. |

More Information

Technically short term credit falls under a few different offerings:

| Collateralized | Traditional collateral (home, equipment, business) is put into the contract. |

| Cashflow | For rental units or businesses, using the cashflow as collateral provides the assurance that the financing will be paid back appropriately. |

| Credit Line | Financing for qualified individuals or businesses with a history of top-quality repayment. |

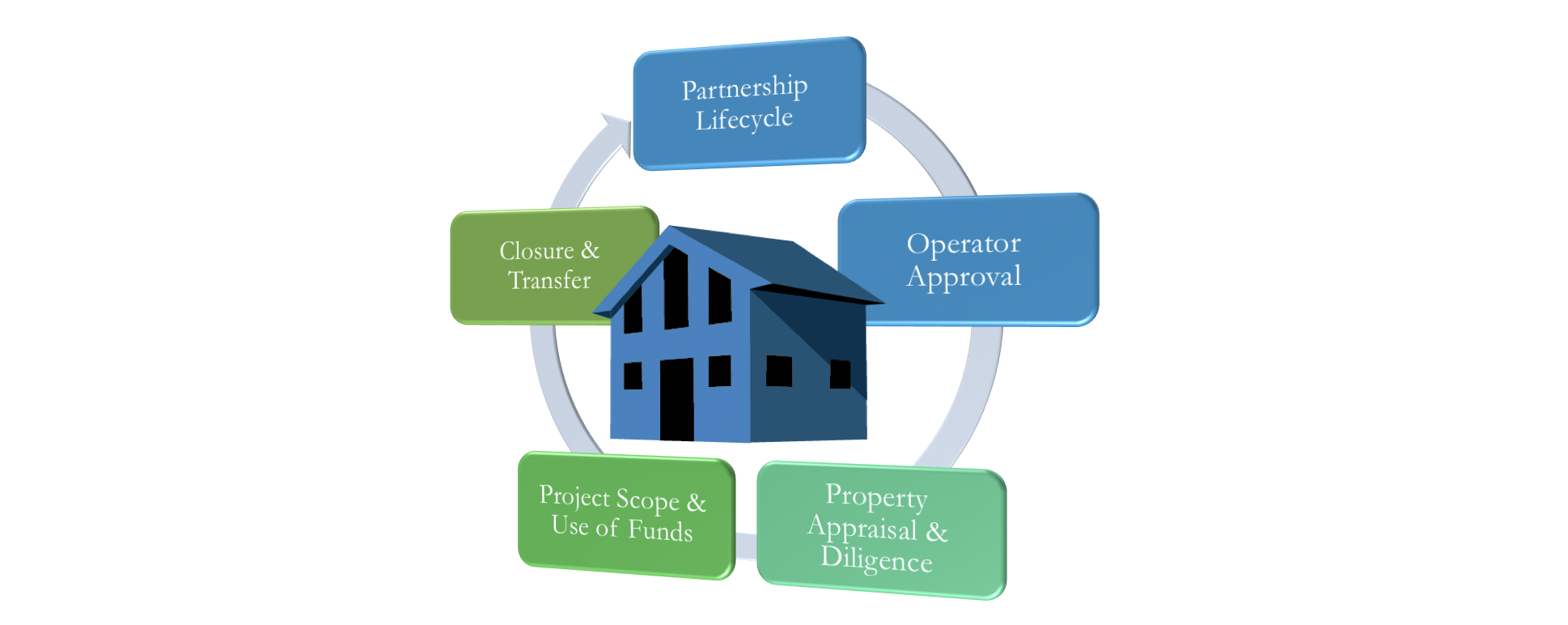

Each project starts with the Partnership Lifecycle

- Operator Approval:

- NDA required

- Standard background checks: W2, drivers license, bank reference

- Experience & expertise

- Property Appraisal & Diligence:

- Appraisals from Operator and Prime

- Analysis of any cash-flows

- Title search and closure

- Project Scope & Use of Funds:

- Timeline

- Architecture review

- List of contractors/vendors

- Measure & manage

- Closure & Transfer:

- Punchlist

- Separation/transfer docs

- Sale closure

Each project starts with the Partnership Lifecycle

- Primary-Owner

- Provides financing

- Leverages assets to build portfolio

- Builds new relationships

- Primary driver is monthly interest

- Secondary-Operator

- Finds properties in growing markets

- Assesses opportunities for viability

- Manages or performs renovations

- Primary driver is total return